What You Need To Know

Learn more about Alberta’s auto insurance system, how reforms introduced by the government are intended to improve auto insurance for Alberta’s 3 million drivers and what you can do to help manage your premiums.

It’s time to rethink Alberta’s Grid system

The current Grid framework is no longer aligned with its original intent. It penalizes safe drivers with higher premiums and incentivizes bad behavior on our roadways. In 2021, total Grid subsidies were estimated to be $180 million. This equates to $65, or 4% of premiums, for every driver. It’s time to rethink Alberta’s Grid system. In order to better understand the current function of the Grid, the Insurance Bureau of Canada (IBC) engaged Deloitte to work with the AIRB and others to assess the Grid’s current framework and impacts, and to provide recommendations that can help better align the framework with its original intent and/or identify an alternative framework that better supports the affordability of new-driver premiums. Read the report here. Learn more about IBC’s recommendations to improve the Grid here.

Direct Compensation for Property Damage (DCPD)

On January 1, 2022, Alberta adopted a Direct Compensation for Property Damage (DCPD) system – which improves the way Alberta’s insurers support their customers following collisions. Click here for a DCPD Questions and Answers document with information from the Superintendent of Insurance and Alberta Insurance Regulatory Board. You can also learn more about DCDP at www.ibc.ca/ab/auto/dcpd.

UPDATED: Reforms to Alberta’s Auto Insurance System

At the end of October 2020, the Alberta government introduced Bill 41: the Insurance (Enhancing Driver Affordability and Care) Amendment Act, 2020. This legislation made changes designed to improve the auto insurance system for Alberta’s 3 million drivers.

On December 9, 2020, Bill 41 received royal assent to update the Insurance Act and all changes to the Act came into effect by early 2022.

The goal of changes made by the Alberta government to the auto insurance system is to help stabilize out of control claims costs, and ultimately help make insurance more affordable for drivers. These changes also give Albertans more and better options for care when they’ve been injured in an accident.

The insurance industry is committed to continue working with the provincial government as they work to further improve the insurance system beyond the changes made to insurance regulations and to the Insurance Act. We’ll be there, speaking on behalf of consumers to ensure insurance is affordable, and provides even more choice and care for consumers when they need it.

Changes to Alberta’s Auto Insurance System – Frequently Asked Questions

In 2020, Alberta’s government made changes to the auto insurance system. These changes were made to address issues that were negatively impacting auto insurance for Alberta’s 3 million drivers.

We’ve assembled some common questions and answers Albertans may have about how these changes are beneficial for drivers.

What Is The Main Cause Of The Rise In Auto Insurance Premiums?

There are many factors that have contributed to increases to auto insurance premiums for Alberta drivers – from more expensive repairs due to new technology in vehicles, to auto theft, to distracted driving.

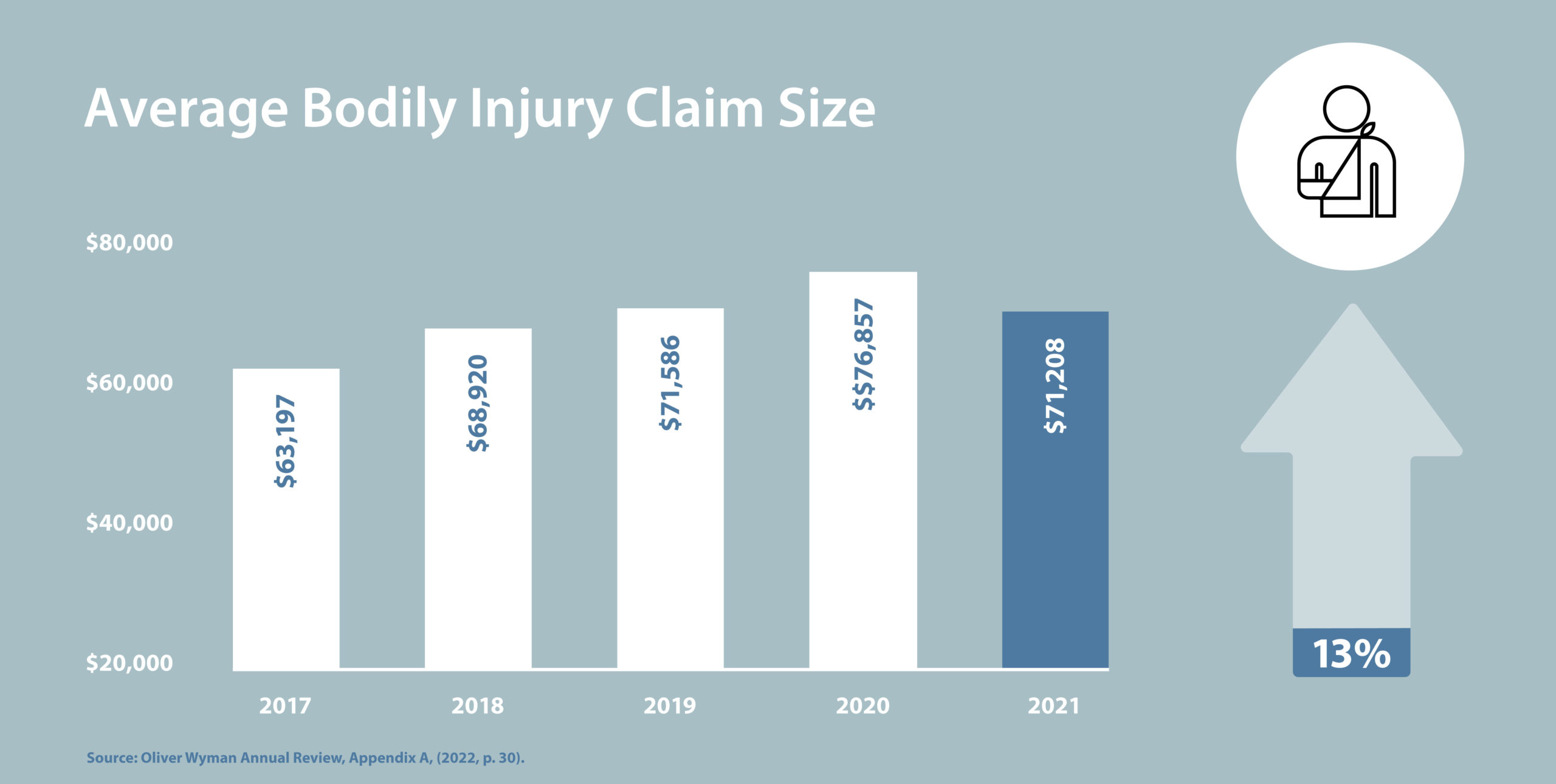

Even with all these factors, the largest contributor to increased claims costs has been the cost to settle injury claims after a collision. This means there are more lawsuits that have settled for higher amounts.

*Sources: 2021 Oliver Wyman Report (2020-2016, p. 12), 2020 Oliver Wyman Report (2015, p. 12), 2019 Oliver Wyman Report (2014, p. 11), 2018 Oliver Wyman Report (2012-2013, p. 13), 2017 Oliver Wyman Report (2011, p.24).