Frequently Asked Questions

Auto Insurance Premiums

There are many factors that have contributed to increases to auto insurance premiums for Alberta drivers – from more expensive repairs due to new technology in vehicles, to auto theft, to distracted driving.

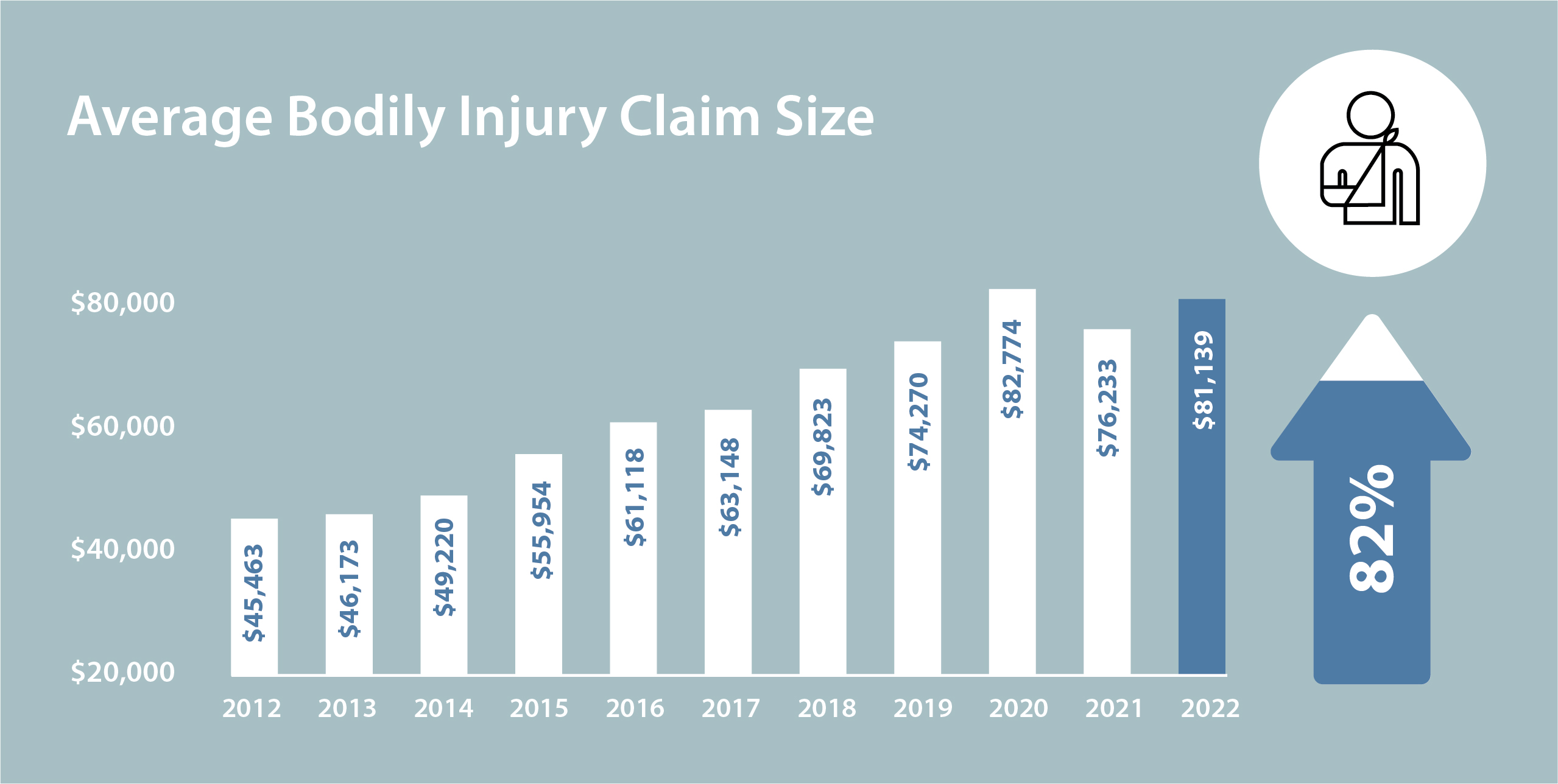

Even with all these factors, the largest contributor to increased claims costs has been the cost to settle injury claims after a collision. This means there are more lawsuits that have settled for higher amounts.

*Source: Source: IBC with data from GISA. Excludes the Health Levy.

Alberta adopted a Direct Compensation for Property Damage (DCPD) system to improve the way Alberta’s insurers support their customers following collisions. You can learn more about DCDP at ibc.ca.

The Superintendent of Insurance approves rating factors that insurers may use to set their rates, such as where an individual lives and their years of driving experience, among others. In addition, the independent rate regulator, the AIRB, reviews auto insurers’ proposed rate changes, including actuarial assumptions such as projected claims cost increases, operating expenses and maximum permitted profit margins. Based on those factors, it makes a decision on insurers’ requested rate changes. AIRB full rate filing guidelines can be found here.

This process takes at least 90 days from the time an insurer submits a rate filing to when the first consumer sees the rate change.

After making a rate change proposal, insurers must wait between 30- and 60-days before those rates are approved. After that, consumers are sent renewal notices at least a month before their new rates are proposed to come into effect. In all, it could take more than 90 days from rates being submitted to consumers seeing those rates. Rates posted today were submitted to the AIRB months ago.

Alberta’s insurers continue to work with the government and stakeholders to advocate for continued balanced changes that will further stabilize premiums for Alberta drivers. There are also 40 insurer groups and companies operating in Alberta that compete for consumers’ business. Consumers should shop around – it is proven to help drivers find better rates.

No. Alberta has a competitive insurance market and insurers compete for Albertans’ hard-earned premium dollars. Many insurers request less than their justified rates as a consumer focused measure or to try to increase their market share.

The AIRB also closely monitors and approves the rates insurers can charge. No insurer can increase or even decrease their rates without explicit approval from the independent AIRB.

Filings go to the AIRB on a regular basis. This could be to request a rate increase or decrease or to change how insurers calculate their rates. The AIRB typically posts approved rates on a quarterly basis, which means that some of the decisions were made up to 90 days before the posting. Filing approval decisions are made in accordance with the Automobile Insurance Premiums Regulation.

The AIRB does not disclose information about rate filing decisions prematurely for competitive reasons, as it might give other companies an unfair advantage over their competitors.

Auto insurance premiums are calculated using many different factors (e.g., number of years driving, claims history, traffic convictions, where the driver lives, and type of vehicle or coverage selected). Different insurers use their claims data to determine how these factors are weighed. For example, some insurers may place a larger emphasis on number of kilometres driven per year, while others place a greater emphasis prior claims history. Factors used must be authorized by the Superintendent.

No. Consumers can choose among different insurers’ pricing mechanisms and benefit options to find a policy that best suits their circumstances. In Alberta’s competitive marketplace, customers can shop around not only for the most suitable product, but also the best price.

Consumer

If you’ve ever been involved in an auto collision you know how stressful the situation can be, especially if you don’t know what to do. You can minimize the stress if you stay calm and follow some simple rules.

First and foremost, if anyone is injured or you think the other driver may be guilty of a Criminal Code offence, such as drunk driving, call 911. Once you’ve assessed that everyone’s safety is secure, follow these steps:

1. Do not leave the scene of the collision. It may be a criminal offence to do so.

2. If there are injuries or if the damage is greater than $2,000, you have a legal obligation to report the collision to the police. You can do so my calling the police to report the collision; depending on the situation, they may instruct you to visit the nearest police station to report the collision.

3. If it’s safe, move the vehicles to the side of the road. If the vehicles aren’t drivable, turn on the hazard lights or surround the vehicles with cones or warning triangles if available.

4. Regardless of the circumstances, never admit fault for the collision, never sign any documents regarding fault and never promise to pay for the damages.

5. Record all collision details. Use IBC’s Collision Report Form.

6. Record what happened and how, and when, where and why it happened, as well as weather and road conditions. If possible, take cellphone photos of the vehicle damage.

7. Collect names, addresses, licence plate numbers, insurance details and contact information for all drivers, passengers and witnesses.

8. Call a tow truck if your vehicle is not safe to drive.

9. Report the collision to your insurer as soon as possible. If you are injured in the collision, you may be eligible for benefits. Submit claims forms as instructed by your insurance company.

Bottom line, it’s best to be prepared in order to manage an auto collision with peace of mind. Print a copy of the IBC’s Collision Report Form and keep it in your glovebox so that you can ensure you capture all the necessary details at the time of the collision accident.

Follow the steps below once it is safe to do so if your vehicle has been damaged by severe weather.

– Assess the damage and call your insurance representative. Most insurers have 24-hour claims services.

– Be as detailed as possible when providing information on damage.

– If possible, take pictures of the damage to your vehicle.

– Be sure to keep receipts related to any cleanup.

Don’t wait until severe weather hits to know if your vehicle is protected. Contact your insurance representative or call IBC’s Insurance Hotline at 1-844-2ask-IBC.

Damage to vehicles from wind, hail or water is covered if you have purchased comprehensive or all perils car insurance. This type of coverage isn’t mandatory, so it’s important to check with your insurance representative to understand what your policy covers. Your insurance representative can also discuss what options are available to ensure your vehicle is covered if severe weather strikes.

Damage to mobile homes or trailers from wind, hail or water may be covered. Contact your insurance representative to find out what your policy covers.

Distracted driving is one of the largest causes of collisions, injuries and deaths on Canada’s roads.1 From texting and being on social media to talking on the phone or eating and drinking when behind the wheel, driver inattention has been found to contribute to approximately 80% of all collisions.2

Distractions impair our driving performance and reduce our awareness, which can result in drivers being slower to notice or less able to safely respond to critical events on the road. Put simply, when you take your eyes and attention off the road your risk of collision increases.3

1CAA, 2021

2IBC Drive Down Your Rates

3Transport Canada, 2019.